carried interest tax proposal

The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried. Carried Interest Tax Proposal.

Election Special Bulletin 1 Tax Plan Proposal

Potential Negative Impact to the Charitable Sector The July 27 draft of the Inflation Reduction Act IRA includes a provision from the September 2021 Ways.

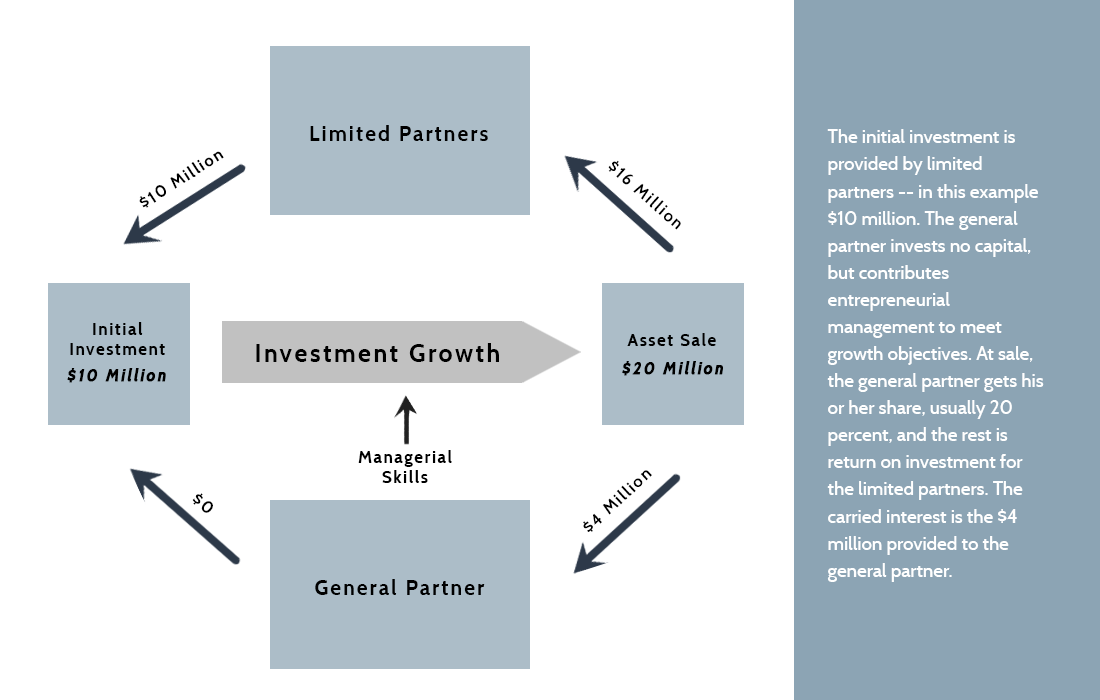

. This article is written by Jingjing Jiang Cindy Shek and Florence Lau. The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

In December 2020 the Financial Services and the Treasury Bureau FSTB of the Government of the Hong. A proposed tax tweak to carried interest compensation paid to private equity and hedge fund managers didnt survive in the final Inflation Reduction Act. See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update.

The Congressional Budget Office has estimated that taxing carried interest as ordinary income. Bidens proposal would have treated such gains as ordinary incomeraising the rate from 20 percent today to 396 percentfor any taxpayer earning 1 million or more. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White.

While the committee stopped short of taxing all carried interest as ordinary income. House Democrats Float 265 Top Corporate Rate in Tax Blueprint. At most private equity firms and hedge.

Unlike previous proposals in other. Present law The Tax Cuts and Jobs Act added Section. On July 31 2020 the Department of Treasury.

The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. Carried interest is very generally a share of the profits in a partnership paid to its manager. To do that he said he would tax long-term capital gains at the ordinary top income tax rate essentially wiping away the special treatment of carried interest.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration could create Securities and Exchange.

At most private equity firms and hedge.

Manchin Says He Is Firm On Closing Tax Loophole Sinema Absent From Caucus Meeting

Clinton S Taxes On The Wealthy Explained Committee For A Responsible Federal Budget

The Carried Interest Debate Is Mostly Overblown Tax Foundation

How Does Carried Interest Work Napkin Finance

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Hedge Pe Funds Object To Carried Interest Tax Hike Proposal Newsmax Com

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22RXIEMDFFN67MGAUYELV7HTYY.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Carried Interest Changes In The Inflation Reduction Act Of 2022 Blogs Foley Funds Legal Focus Foley Lardner Llp

Greg Sargent On Twitter News More Details About Manchin Schumer Deal Total Revenue 739 Billion Tax Reform Irs Enforcement 15 Corporate Minimum Tax Closing Carried Interest Loophole Spending 369 Billion In Energy Climate 64

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

What Is Carried Interest And How Is It Taxed Tax Policy Center

What Would The New Carried Interest Loophole Proposal Do The New York Times

Democrat Tax Hike Proposal Leaves Carried Interest Loophole For Billion Dollar Private Equity Funds Private Equity Models Valuation Tools Made Simple

The Tax Treatment Of Carried Interest Aaf

A Tax Loophole For The Rich That Just Won T Die The New York Times

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg