inheritance tax wisconsin rates

Your average tax rate is 1198 and your marginal tax rate is 22. Maryland is the only state in the nation that levies both an inheritance tax and an estate tax.

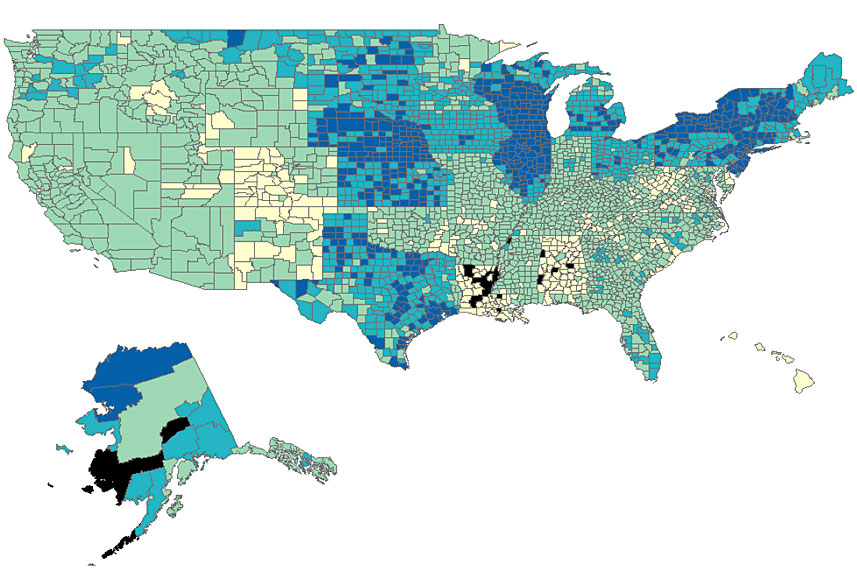

Property Taxes Property Tax Analysis Tax Foundation

The inheritance tax will vary by state but is generally a function of the states tax rate and your relationship to the decedent.

. If you are a sibling in New Jersey for example and the estate is 24000. A federal estate tax is in effect as of 2021 but the exemption is significant. Caucasians have higher rates of ALS than other races.

The highest individual income tax rate tops out at 765 in Wisconsin. 2022 Muscular Dystrophy Association Inc. Once you have valued the estate properly you will then need to look at the tax tables for the state to which you must pay inheritance tax.

Prior to the age of 65-70 the incidence of ALS is higher in men than in women but thereafter the gender incidence is equal. District of Columbia State offers alternative apportionment factors as well either as an optional election or as a requirement for select industries. Is a qualified 501c3 tax-exempt organization.

Oregons estate tax rates changed on January 1 2012 so that estates valued between 1 million and 2 million would pay slightly less in estate taxes and estates. Get a list of states without an estate or inheritance tax. About 5 to 10 percent of ALS is.

The Tax Foundation is the nations leading independent tax policy nonprofit. State Corporate Income Tax Rates and Brackets for 2020. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

These rates are for the 2020 tax year the year for which returns are due this spring according to the Tax Foundation. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. However living in the state might not be as tax.

A Very Short Primer on Tax Nexus Apportionment and Throwback Rule. Wisconsins personal income tax rates range from 354 to 765 as. Wisconsin The Badger State is sure to pester its wealthiest residents to pay up at tax time.

The state income tax rates range from 14 to 107. This marginal tax rate means. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption.

Marylands personal income tax rates range from 2 to 575 but the state excludes Social Security benefits from income.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Estate Tax Everything You Need To Know Smartasset

Property Taxes In 2022 For Each State Ranked Digg

Estate Tax Rates Forms For 2022 State By State Table

Wisconsin Estate Tax Everything You Need To Know Smartasset

Wisconsin Losing Ground To Tax Reforming Peers

2022 Property Taxes By State Report Propertyshark

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

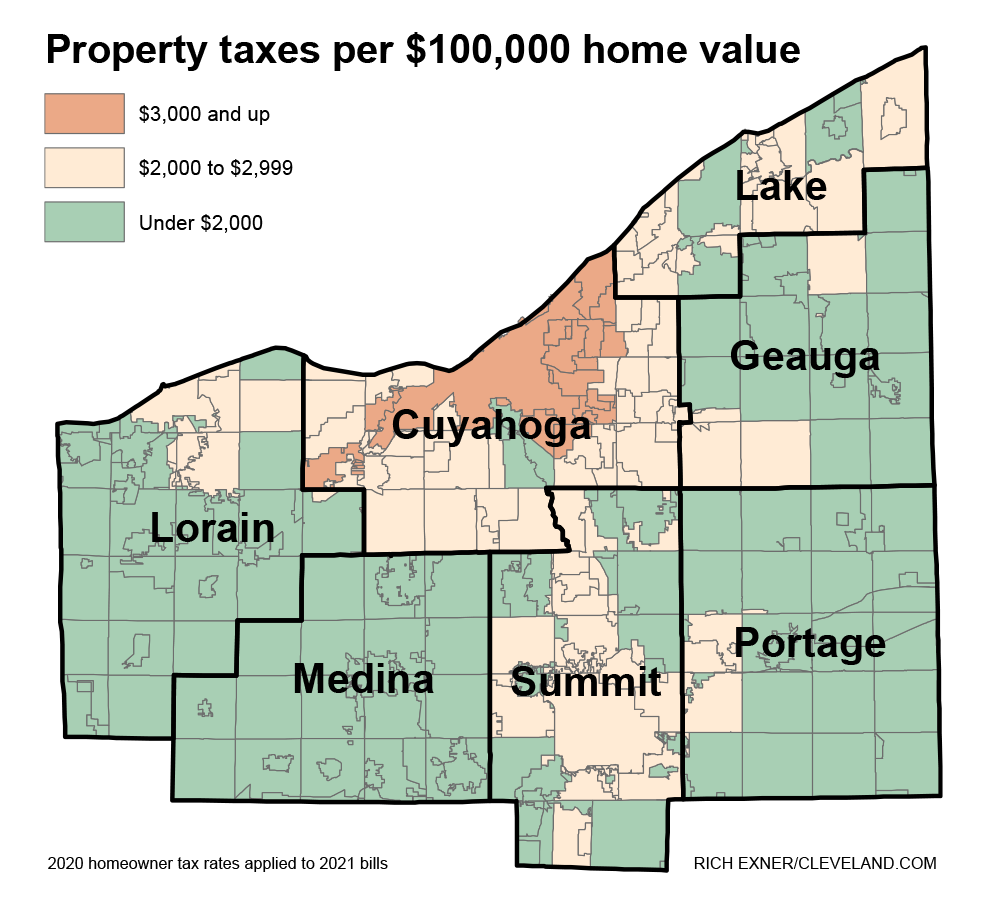

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State And Local Individual Income Taxes Work Tax Policy Center

Estate Tax Rates Forms For 2022 State By State Table

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

How Is Tax Liability Calculated Common Tax Questions Answered